Daniel Smith

Keeping Pace with the Evolving Landscape of Channel Partner Programs

In today's fast-paced business environment, the dynamics of sales channels are undergoing a profound transformation. Traditional methods are being challenged by evolving consumer behaviors, technological advancements, digital transformations, and the emergence of new stakeholders. As businesses adapt to these changes, the impact on channel partner programs becomes increasingly significant. Let's delve into how these shifts are reshaping the landscape of channel management and what strategies businesses can employ to navigate this evolving terrain.

What will AI in Supply Chains Look Like?

With all the excitement around AI these days, there is no shortage of opinions on what this will mean to us, both personally and to society as a whole. In one corner are tech fans who see AI as the cure-all to solve all our problems. In the other corner are the doomers who fear AI as a one-way ticket to end the human race, either self-inflicted or by the hands of machine overlords. While both make good headlines, it's likely to play out somewhere in the middle, varying by industry and skills involved.

E2open Strengthens Leadership Team, Announces Chief of Staff and Sector President Appointments

AUSTIN, Texas – April 9, 2024 – E2open Parent Holdings, Inc. (NYSE: ETWO), the connected supply chain SaaS platform with the largest multi-enterprise network, announces the appointment of John McIndoe as EVP, chief of staff to the CEO on the executive team, and Steve Baird as sector president for North America on the global commercial leadership team.

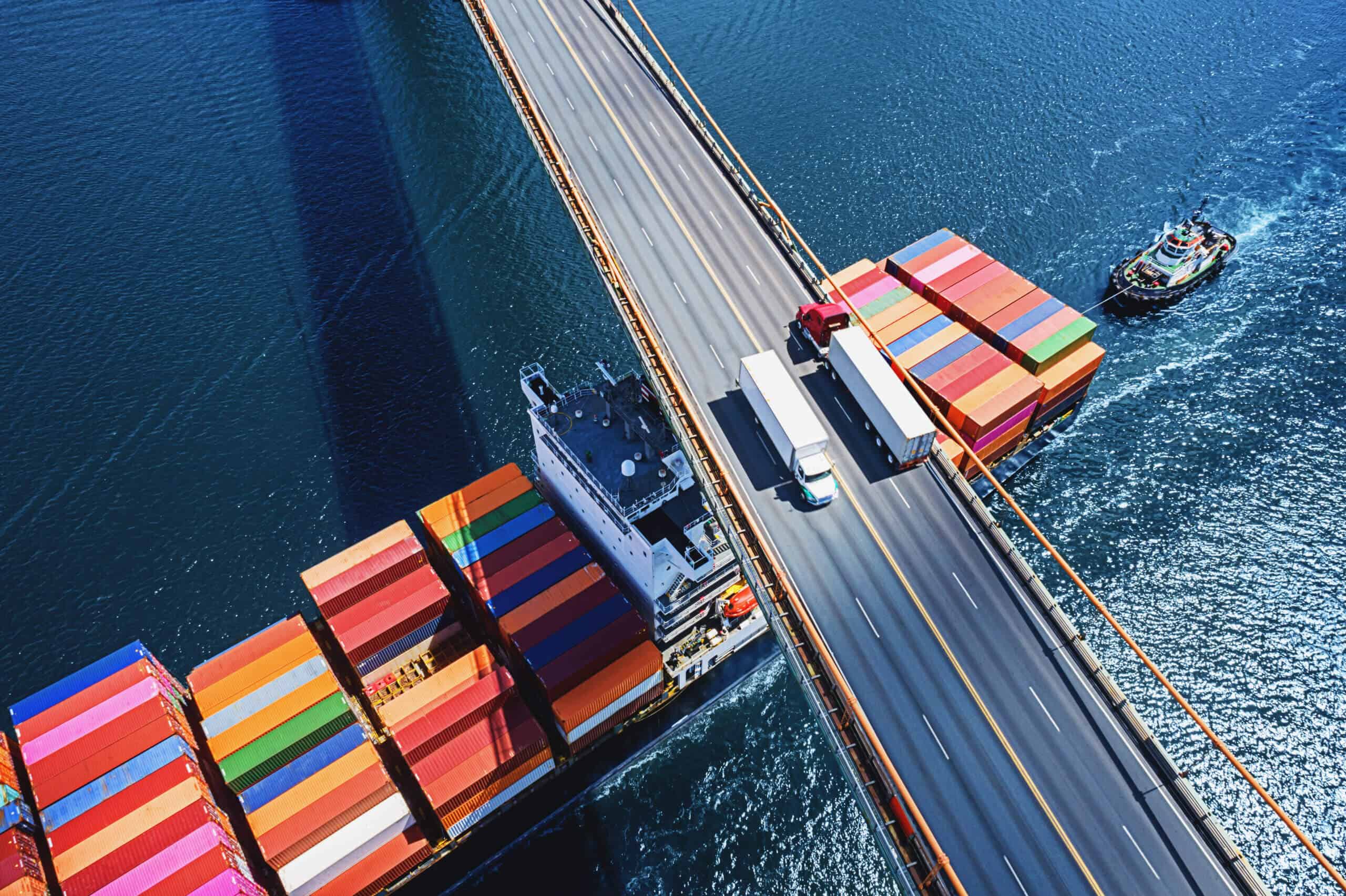

The Baltimore Bridge Collapse: Three Industries That Will Be Hit Hardest

If you were to stand on the load platform at the massive Domino Sugars refinery along the Port of Baltimore today, you would see the collapsed remnants of the Francis Scott Key bridge in the distance. The bridge was a vital piece of the city’s infrastructure and a notable part of its visual identity. In addition to the unfortunate loss of life, there was also a tremendous loss of property, and the rebuilding process could take years and cost hundreds of millions of dollars.

E2open Again Positioned as a Leader in 2024 Gartner® Magic Quadrant™ for Transportation Management Systems

AUSTIN, Texas – April 2, 2024 – E2open Parent Holdings, Inc. (NYSE: ETWO), the connected supply chain SaaS platform with the largest multi-enterprise network, today announced that e2open has been positioned by Gartner as a Leader for the second consecutive year in the 2024 Magic Quadrant for Transportation Management Systems1. The evaluation was based on specific criteria that analyzed the company’s overall Completeness of Vision and Ability to Execute.

E2open Gets into the Spirit During Sprit Week

Supply & Demand Chain Executive, the only publication covering the entire global supply chain, named Pawan Joshi, EVP of product and strategy at e2open, as one of the winners of this year’s Pros to Know award in the Lifetime Achievement category. The Pros to Know Award recognizes outstanding executives whose accomplishments offer a roadmap for other leaders looking to leverage the supply chain as a competitive advantage.

E2open’s Pawan Joshi Recipient of 2024 Pros to Know Award

Supply & Demand Chain Executive, the only publication covering the entire global supply chain, named Pawan Joshi, EVP of product and strategy at e2open, as one of the winners of this year’s Pros to Know award in the Lifetime Achievement category. The Pros to Know Award recognizes outstanding executives whose accomplishments offer a roadmap for other leaders looking to leverage the supply chain as a competitive advantage.

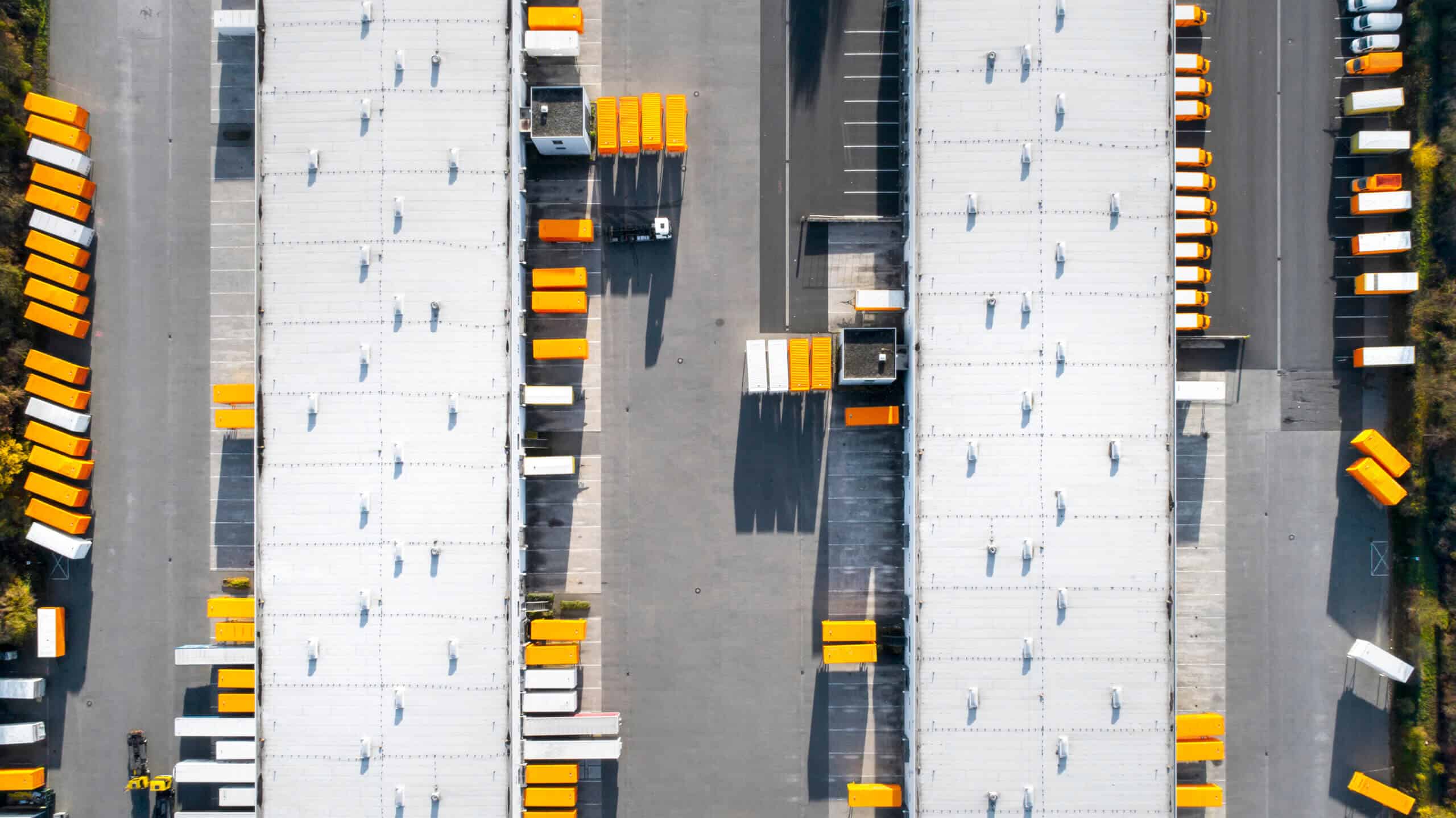

Logistics as a Service: The Value of Strong Relationships

Why can a successful team accomplish more together than its members can achieve independently? While many complex dynamics are involved with teamwork, the answer to this fundamental question is simple. Successful teams accomplish more than individuals because their members develop synergy. In other words, they can work together in a manner where their combined output is greater than the sum of their individual efforts. Synergy is the secret sauce separating great teams from good teams and is a key ingredient differentiating e2open’s Logistics as a Service (LaaS) offering from others in the managed transportation services (MTS) space.

Employee Spotlight: Marty Flemington

E2open is powered by a strong global network of problem solvers and innovators driven by strong values and our company culture. Together, we are focused on doing what’s right in business and in our communities. Every month, we will shine a spotlight on an exceptional team member who is helping us transform the supply chain industry. This month, we held a Q&A with Marty Flemington, Principal Software Engineer at e2open.