Update: As of October 4, 2024, the ILA and USMX have, for now, come to an agreement, it doesn’t mean that supply chain leaders should stop preparing for other future disruptions such as this.

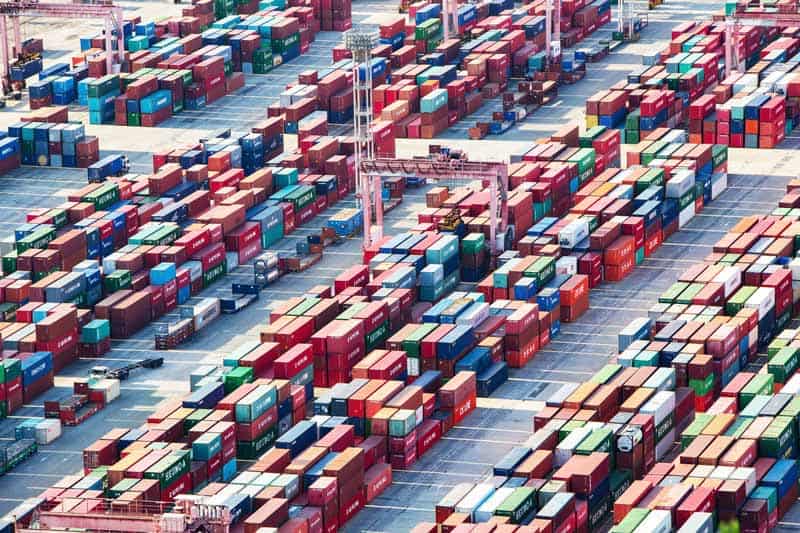

Thousands of dockworkers along the East and Gulf coasts began a historic strike just after midnight on October 1, 2024. This work stoppage, the first of its kind since 1977, has brought operations to a grinding halt at 14 major ports from Texas to New England, threatening to disrupt the flow of more than half of the nation’s containerized trade. Unlike the major strike in the 70’s, our reliance on the global economy and supply chains is now much greater, so the shutdown is expected to have a wide and immediate impact, from the shortage of everyday items to increased shipping costs, retail prices, and the global transportation infrastructure.

In this blog, you’ll learn what’s happening and why, expected economic and industry-related impacts, and five strategies companies can use to mitigate the repercussions of this port strike and build more resilient supply chains for the future.

The strike: who, what, and why

The International Longshoremen’s Association (ILA) and the United States Maritime Alliance (USMX), the ocean carriers and port operators, have reached an impasse in contract negotiations when eleventh-hour efforts to come to an agreement were unsuccessful. At the heart of the dispute lies two key issues: wages and automation.

The USMX did offer a 50% wage hike over six years, but ILA rejected the proposal. Concerns over increased automation of cranes, gates, and container-moving trucks also loom, as dockworkers fear it could threaten their job security. This deadlock in negotiations has led to picket lines in the Ports of Boston, New York/New Jersey, Philadelphia, Baltimore, Norfolk, Wilmington, Charleston, Savannah, Jacksonville, Miami, Tampa, Mobile, New Orleans, and Houston.

Immediate impacts of the port strike

The repercussions of this strike are already being felt across industries:

- Cargo backlogs and delays: Over $2 billion worth of goods flow through these ports daily. With operations halted, everything from furniture and shoes to paper, farm machinery, holiday gifts, and medications are stuck in limbo.

- Perishables at risk: Refrigerated and hazardous goods are particularly vulnerable, facing potential spoilage or degradation before they reach their destination.

- Economic consequences: Experts predict that a one-week strike could cost the U.S. economy a staggering $3.78 billion. A strike that lasts longer could lead to shortages and price hikes as shortages increase.

Industry-specific fallout

Automotive sector

The automotive industry stands to be one of the hardest-hit sectors due to the reliance on specific parts. “If a manufacturer is counting on receiving certain components, not having them can make a substantial difference,” John Lash, Group Vice President of Product Strategy at e2open, explains. “It’s not just about the value of delayed imports and exports. A $10 part can be essential for a $50,000 vehicle. Not having these parts can significantly impact production, creating an amplification effect within the manufacturing chain.”

Retail and consumer goods

Perishable consumer goods such as fresh fruits and vegetables will likely feel the impact much sooner than non-perishable products such as cosmetics, which may have already been pre-positioned in the market. U.S. customers will likely see prices go up as availability becomes more limited for these items. As for how much of an impact this will have on consumers, Pawan Joshi, EVP of Products & Strategy at e2open, notes: “Much depends on how much the strike lasts. For short strikes of 1-5 days, the impact will be minimal.”

For retailers, the port strike comes at a less-than-ideal time – right before the holiday shopping season is set to kick into high gear. Fortunately, many large retailers box stores like Walmart and Target have already stocked up in anticipation of the impending disruption. However, medium to small-sized retailers could face significant hurdles, as they don’t have the capital or capacity to stock up on large amounts of inventory ahead of time as the bigger retailers do. Even after the strike, smaller stores will face disadvantages in trying to get stock back on their shelves – larger orders get priority when inventory is unloaded at ports.

Five mitigation strategies for companies impacted by the port strike

While the port strike presents significant obstacles, businesses, and logistics providers can actively implement five strategies to help mitigate its impact. These efforts will help maneuver through the current issues and also contribute to building more resilient supply chains for the future.

Alternative routes and methods

Companies are already pivoting to divert their cargo to the West Coast or Canada, but these ports have limited capacity to absorb the overflow, and rerouting shipments involves the complex task of rerouting entire logistics networks, managing longer transit times, and increasing transportation costs.

Alternatively, some businesses, especially those dealing in high-value or time-sensitive goods, are turning to air shipping. This option offers greater speed and reliability, but is 5-10 times more expensive than ocean shipping, has lower capacity, and has a higher environmental impact.

But how do you know which alternative route or mode is the best one? E2open’s Global Logistics capabilities can help predict potential bottlenecks caused by the port closures and suggest routes, or other corrective actions for inventory moves, all while providing accurate, updated ETAs so you know when your goods will reach their destination.

E2open can also help you anticipate some of these delays and minimize their impact. Our predictive analytics capabilities leverage artificial intelligence (AI) to determine which shipments will be on time, late, or early.

Inventory management

Proactive businesses, particularly larger retailers, have been preparing for the port strike by stocking up on inventory to weather this (hopefully short-term) disruption. But to minimize the cost of this strategy, companies need more sophisticated inventory planning and demand forecasting. AI-powered demand sensing offers precise forecasting for optimal inventory allocation across channels and locations based on real-time demand indicators.

Is there any proof that AI-powered demand sensing makes a difference during a major disruption? Yes! We have the data to prove it. Check out our 2024 Forecasting and Inventory Benchmark Study for specific examples of how supply chain leaders can improve supply chain resilience.

Multi-echelon inventory optimization (MEIO) software provides more accurate inventory targets at all stocking echelons in the value chain, including internal operations, suppliers, and channel ecosystems. The platform helps you gain strategic positioning by distributing inventory across multiple locations and reduce your reliance on certain ports.

Supplier diversification closer to end markets

Longer-term, companies can consider reassessing and diversifying their supplier networks closer to end markets to reduce reliance on shipping goods so far away or dual-sourcing to maintain relationships with multiple suppliers for more critical components. However, there’s also the matter of due diligence and reducing risk, which can hide within your supplier network.

Supply network discovery tools can help you uncover the risks hiding in your supply network by leveraging multi-tier supplier discovery, relationship mapping, and product traceability in every tier. Due diligence and partner impact assessment capabilities provide unmatched transparency into your supply network and ensure compliance across the board. Some of these platforms also eliminate the need for manual processes and functional silos by automating and streamlining the exchange of information.

Influence and manage inventory and demand

Retailers facing potential shortages can employ creative strategies to help manage inventory and demand by adjusting pricing on goods based on availability. For example, a clothing company might run low on a pair of jeans because new shipments aren’t coming in due to the strike. The company might instead consider raising prices on that item and lowering prices on another item that they have a higher quantity of, until the strike is over or until they are able to get a new shipment in. This way they lower the demand for the now higher-priced item and increase the demand for the lower-priced item.

E2open’s Demand Signal Management application is a software solution designed to provide early data-based insights to empower you to respond quickly to market shifts and adjust inventory to improve on-shelf availability in normal circumstances, or during disruptions like this. Smart algorithms help initiate corrective actions when inventory levels are low, and pricing is off.

Supply chain technology

The strike underscores the value of advanced supply chain technologies and increased collaboration with supply chain partners in managing complex disruptions. Real-time visibility of shipments and inventory, AI-powered analytics that offer predictive capabilities, and “digital twin” simulations for scenario planning and risk assessment can make the difference for companies that need a more resilient, agile, and responsive supply chain.

Leveraging the power of a vast partner network allows you to connect all trading partners and logistics providers across all tiers and ecosystems, giving you real-time visibility, connectivity, and collaboration outside your company’s four walls. A unified platform can then harmonize, cleanse, and enrich data from all your supply chain ecosystems using AI and automation to make it decision-grade.

Those who embrace these technologies and strategies now may find themselves better equipped to handle future challenges and capitalize on new opportunities in the global marketplace.

The road ahead

If the strike continues past two weeks, its impact on the U.S. economy and global supply chains will only intensify. New goods won’t be able to make it through the ports or will take longer to be shipped to other entry locations, creating setbacks for manufacturing, and for consumers who won’t be able to find what they need. The situation underscores the critical need for resilient and adaptable supply chains.

While the immediate focus is resolving the current impasse, this event serves as yet another reminder that businesses need to diversify their logistics strategies and invest in robust supply chain technologies. As we tread through this rocky road, one thing is clear: companies that successfully navigate disruptions such as this one will emerge stronger, with more flexible and adaptive solutions that are better equipped to handle future supply chain disruptions.

If you’d like to learn more about how e2open can help your company build supply chain resiliency, please contact us.